Historical Barriers Impact Minority Development Today

June 1, 2025

The under-representation of BIPOC real estate developers in Delaware can be traced to generations of systemic, economic, and social barriers such as redlining, restrictive regulations and biased lending practices. These factors have made it more challenging for people of color to accumulate the financial resources and project experience to undertake large-scale development projects.

Years of experience

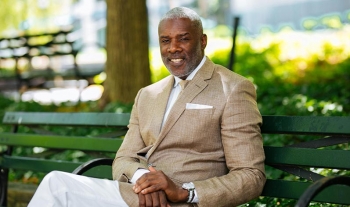

“This is a game built for people who are already established,” explained Christopher Pitt, Managing Partner of PittPass Development. “It can take years to gain the experience necessary to successfully undertake a project and gain access to collateral that justifies the required funding.

“As a small business owner, you have to prove yourself. And while you’re finding your way through the intricacies of getting funding, you’re still the developer, the general contractor, and the banker. You’re doing it all,” he said. “In the beginning, you’re taking a significant risk. You can put $50,000 into a project without seeing a return for several years.”

Industry connections

In addition, access to networks and mentorship cannot be overstated in the real estate industry. Many of the most successful developers rely on established connections and industry knowledge passed down through generations. New to the industry, minority individuals often lack these networks, limiting their opportunities for collaboration, learning, and investment.

“Black women in particular lack networking in this male-dominated industry,” said Alicia Cooper, CEO of MS Cooper Home Loans. “Women can be afraid to jump in – we constantly disqualify ourselves and think we can’t do this. Without strong role models and mentors, getting started is a steep climb for women of color.”

Capitalization and Capacity

The minority wealth gap — minorities still average only 15 percent of the median wealth of white households — often mean that developers of color have to start slowly and with small projects.

“Starting out, we run into questions about capacity, track record and net worth, and often lenders find us lacking in some of those categories,” said Pitt. “You have to prove yourself, and with one project at a time, it can be a very long onramp for people of color.”

As a mission-driven non-profit CDFI, True Access Capital has been breaking down barriers to entering the real estate development space, with a wide range of funding opportunities, providing technical assistance, mentorship and a welcoming place for entrepreneurs to share and learn. Our Northeast Revitalization Fund (NRF) community development loans have injected more than $2.4 million into the Northeast Wilmington corridor and all loans were extended to BIPOC businesses and developers. Learn more about the NRF at the video here: https://www.youtube.com/watch?v=thMeYmcEn-Q&t=355s

Changing the paradigm

The good news is that new training programs and real estate accelerators can help BIPOC entrepreneurs get started on the best path. Through services such as PittPass Development Group, MS Cooper Home Loans, and Cinnaire, the opportunity is on the horizon.

Cinnaire is a nonprofit community development financial organization that invests in people and places to transform communities through capital investments and development solutions. Their local initiative, Jumpstart Wilmington is designed to help people committed to revitalizing Wilmington become developers in their own neighborhoods through community-focused real estate development training and financing options.

“Jumpstart Wilmington has three components: training on real estate fundamentals, mentoring and networking for both for-profit and non-profit business, and access to capital for people with little equity and previous rejections from traditional banks,” said Cinnaire’s Dionna Sargent. Launched in 2020 during COVID, Jumpstart has seen some 130 graduates, 30 active development projects — including single family homes, mixed-use properties, renovations and rehabs – in Northeast, EastSide, WestCengter City, and Southbridge sections of Wilmington.

Alicia Cooper-Wells refers to herself as a serial entrepreneur has established two training and lending businesses: Ms. Cooper Home Loans and Goat Funding Solutions. Alicia says, “when other lenders say no, we say yes.” She explains that her companies look at different criteria from what traditional banks use. “Traditional banks have an income focus – they look at business credit and business income to decide if the borrower will be able to repay. But entrepreneurs of color may not show well in those categories. We look at other indicators such as personal credit and personal cash flow.

The author of Empowering Your Finances: The Ultimate Guide to Building Stellar Credit and Achieving Financial Freedom, Alicia began as a single mother living in the projects. There was no way she was staying there. She built her businesses from scratch and today owns more than 100 properties.

The PittPass team of Chris Pitt and Will Pass said, “We want our business to be a platform for job creation, opportunity for ownership and mentorship for inspiring minorities aspiring to be a successful developer in an unrepresented industry. We believe individually we can do good things, but collectively we can make a huge impact with our various specialized professional backgrounds.

Bright future ahead

Overcoming barriers that prohibit minority entrepreneurs from growing into major real estate development enterprises is imperative for the redevelopment of underserved and blighted areas of Wilmington.

New options beyond traditional banks, such as CDFIs and social impact-driven lenders that incorporate training and mentoring in real estate, finance, technical skills, and enterprise management provide essential knowledge and skills tailored to the unique challenges faced by minority developers.