What we’re all about

The True Access Mission is building a thriving community by empowering entrepreneurs and businesses through access to capital, education, advocacy and opportunity.

Our Vision

The True Access vision is for a vibrant, inclusive community, where all entrepreneurs and small businesses can realize their dreams.

Our Values

True Access Capital is passionate in its efforts to provide creative and innovative solutions to meet employer, customer, and partner needs.

Our History

Back in 1992, when the Episcopal General Convention recognized the need to uplift underserved communities in Wilmington, Delaware, they acted. Leaders of the convention brought together a dynamic mix of community champions to establish the First State Community Loan Fund. The fund wasn’t just about money; it was (and is) about fostering growth and providing support to local organizations and entrepreneurs in low-income areas.

As time went on, the impact of the fund reached beyond Wilmington, stretching its influence across Delaware and southeastern Pennsylvania. As the organization flourished and expanded its offerings to include training, technical services, community development initiatives, and more, the fund embraced a new identity: True Access Capital.

From inception, True Access Capital has been on a mission to empower small businesses and community organizations, with a strong focus on meeting the needs of underserved communities.

True Access Capital

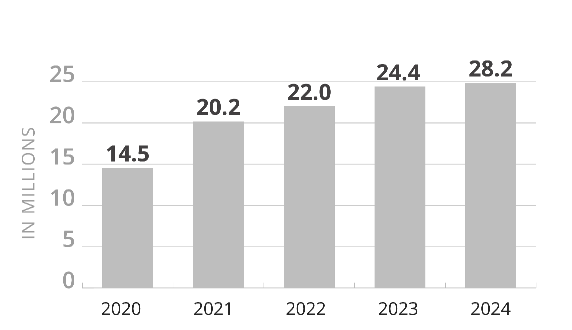

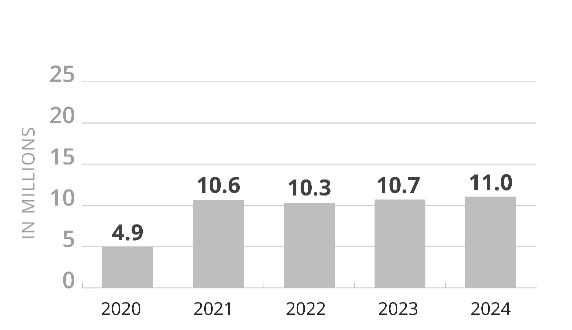

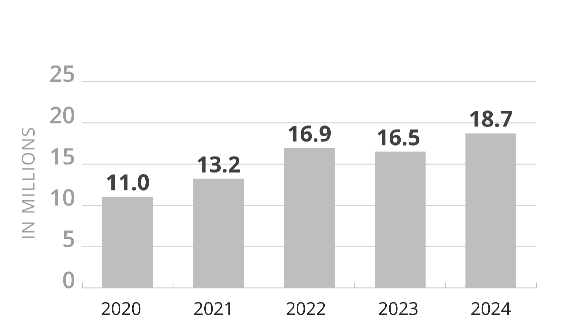

Loan Commitments

Questions? Send us a message.

We’ll be in touch!

Our Team

Our Board

Justin D. Poser

Chairperson

Executive Vice President

M&T Bank

Barry L. Lott

Director

National Council on Aging (NCOA)

Rafael X. Zahralddin, Esq.

Partner

Lewis Brisbois

Gregory M. Makosky

Vice President

Artisans Bank

Joseph W. Wilson

Vice President

PNC Bank

Rachael Mears

Treasurer

Assistant Vice President

Synchrony

Emanuel V. DeShields

President

DE Quest Insurance Group

Lissa Brutus

Assistant Vice President

WSFS Bank

Helen R. Foster, JD

Small Business Enterprise Coordinator

New Castle County Government

Thomas E. Hanson, Jr., Esq.

Vice Chairperson

Partner

Barnes & Thornburg

Robert Gunter, Sr.

Senior Financial Officer

City of Wilmington

Ron Kimbrough

Executive Committee Member

Senior Vice President

Citi

Jerry A. Alfano, Jr.

Senior Vice President

Citizens Bank

Investors & Contributors

Ready to make a difference? When you donate to True Access Capital, you’re not just giving; you’re investing in the growth of small businesses, job creation, affordable housing, and community development programs in underserved communities in Delaware and southeastern Pennsylvania.

Your contribution isn’t just appreciated; it’s essential. Every donation to True Access Capital goes directly to helping provide the loans, consulting services, and support that businesses and community organizations need to thrive.

Ready to put your money to work improving our community?

To make a secure online donation to our General Fund, simply click here. Prefer old-school methods? No problem! Mail your check to:

True Access Capital, 100 West 10th Street, Suite 300, Wilmington, DE 19801

Thank You for believing in True Access Capital

Thank you to every organization that supports True Access Capital. Your support means everything to the communities we serve.

Investors

Artisans’ Bank

Bank of America

Barclays Bank of Delaware

Borough of Kennett

Catholic Health Initiatives

Cinnaire

Citizens Bank

Customers Bank

Deutsche Bank Trust

Company Delaware

First Priority Bank

First Unitarian Church of Wilmington

HSBC Bank USA, N.A.

Meridian Bank

M&T Bank

Opportunity Finance Network

Sisters of St. Francis of Philadelphia

TD Bank, N.A.

Unitarian Universalist

Common Endowment Fund

USDA – Rural Development

U. S. Small Business Administration

WSFS Bank

Contributors

Artisans’ Bank

Bank of America

Charitable Foundation

Bancorp (The)

Capital One

Center Dynamics

Community Development

Financial Institution

Christiana Care

Citizens Bank

City of Wilmington

Comenity Bank

Discover Bank

Girard & Faire

HSBC Bank USA, N.A.

JPMorgan Chase Foundation

Laffey McHugh Foundation

Longwood Foundation

Malvern Bank

Santander Bank

TD Bank, N.A.

USDA – Rural Development

U. S. Small Business Administration

Welfare Foundation

Wells Fargo Foundation

WSFS

Individual Contributors

Kevin Allen

John Bonhomme

Maggie Cook-Pleasant

Jim Donahue

Gina Hampton

Vandell Hampton, Jr.

Sheila Harrigan

Deborah Harrison

Jimmy Jarrell

Sara Crawford

Daniel Kempski

Delores Lee

Phyllis McCollum

Rachael Mears

Pedro Moore

Sue Smith

Robert Snowberger

Melanie Thomas-Price

Leroy Tice

Clinton Tymes

Pedro Viera

Azeez Weeks

Neil Wright

Questions? Send us a message.

We’ll be in touch!