TRUE ACCESS CAPITAL2021 Annual Report

JERRY DEEN’S FAMILY RESTAURANT

We feel that knowledge is as important as capital to help our borrowers thrive and grow their businesses, and our courses are open to our borrowers at any time, not just at the origination of the loan.

— Vandell Hampton, Jr. , President & CEO

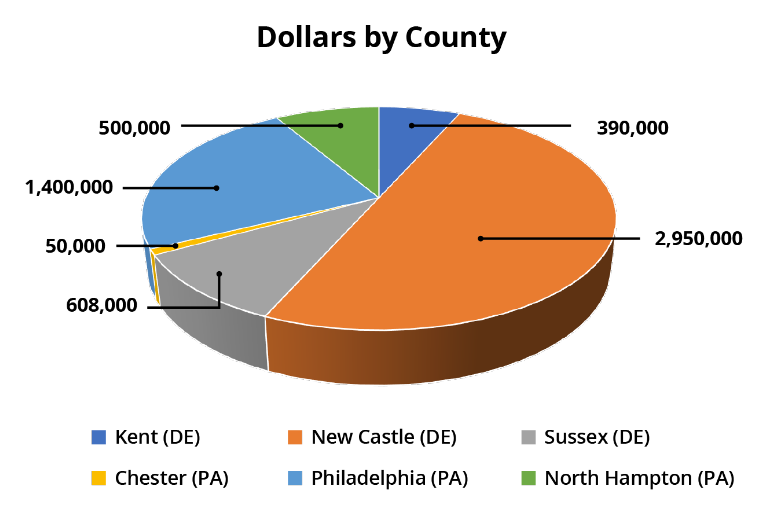

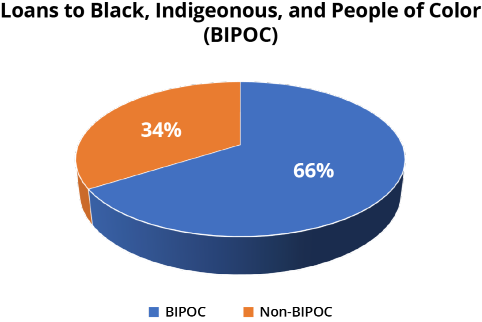

This year’s annual report, Investing in People and Impacting Communities, tells the story of True Access Capital, expanding its lending and technical assistance services to underserved communities throughout our region. Our expansion into southeastern Pennsylvania, has yielded nearly $2 million in loans to small and Black, Indigenous, People of Color (BIPOC) businesses, which represents, 33% of our total lending in 2021.

To raise our visibility, we increased our marketing and outreach efforts. We reached out to, and developed partnerships with organizations in the communities in which we hoped to reach, who were known to local residents as trusted advisors. These organizations had close relationships and deep and wide reach in Black and Brown communities. We continually evaluated our financial products, services and educational offerings, to ensure we met the needs of the populations we served.

We make these special efforts because we know that investing in small businesses, means investments in long-term wealth that will carry through to future generations. Each thriving business adds jobs, provides a local service or product, revitalizes a vacant space, and contributes to the health and safety of our neighborhoods.

We are honored to invest in people, whose success impacts their communities!

Program Director

The Women’s Business Center at True Access Capital

2021 Accomplishmentsby the Number

As a woman entrepreneur, with my own lifestyle brand, I learned firsthand the obstacles that start-up businesses experience and the barriers entrepreneurial women face, as they begin and grow businesses.

Having worked with many aspiring and existing business owners at the Women’s Business Center (WBC) for the past seven years, I have observed that the businesses that survive and thrive are those whose owners understand that success is more than just a great product or service; it has to do with actively and intentionally managing all aspects of the business, from budgeting and understanding the financial intricacies of their given industry, to marketing. I’ve seen that many individuals starting a business lack knowledge in these specific areas and need coaching and mentoring to aid in their understanding.

This is why I am proud of our work at the WBC: our dedication to providing education, continued mentorship, ongoing support, and business training and programming, for all stages of business ownership.

Now, after more than two years, our community is still navigating through COVID-19. The WBC has continued many of the virtual initiatives and trainings we implemented before and during COVID, such as the Virtual Blueprint, Woman-Owned Small Business Certification, Finance 101, E-Commerce Boot Camp and more.

As I move around our community, I see so many entrepreneurs I recognize from WBC initiatives and events. These businesses are thriving, after completing our training sessions, received one-on-one counseling, or participated in our networking events. These businesses are creating jobs, impacting our communities, enriching families and creating generational wealth. We are pleased to be part of this exciting journey. When people come to us with their ideas and goals, we support the development of their business strategies and plans. We share their joy in seeing their dreams come to fruition.

I feel a tremendous sense of achievement and at the same time, I see how much more needs to be done. I am fortunate to be in an organization that allows me to serve our community in such a great way.

Sincerely,

Sara A. Crawford, Director WBC

WBC Programmatic Achievements

- Held the First Annual H.E.R. Business Plan Competition, awarding $15,000 in prizes. From the announcement date in March 2021 to the submission deadline in August later that year, women-owned businesses received business counseling on their business plans.

- Established an E-Commerce Boot Camp. The boot camp included four weekly, virtual sessions, which taught participants how to conduct business, via the internet, including understanding online functionality, marketing, and assistance setting up Shopify stores.

- Led and curated the Sixth Annual Her Story, Our History event, during Women’s History Month. This event honored ten women who excelled in business or were community changemakers.

- Hosted our second virtual Connect Series that allows Women and Entrepreneurs to meet and engage with other innovative business owners. This series encourages women to be more confident, meet new contacts, and learn new ideas on how to grow their business.

Jerry Deen’s Family Restaurant

Charly Bass, Founder

Union jobs are great jobs, except if you have one that involves layoffs. Charly Bass’ job cooking at the oil refineries in Delaware City involved frequent layoffs, leaving her with periods of no work and little income. But Charly had a skill she could; she would cook and sell food when she wasn’t on the job. It was during one layoff that she got the idea to open a restaurant. more >

Snow and Associates General Construction

Tony Snow, President

It is some people’s dream to have a family business they could step into once they finish school. But that wasn’t the case with Tony Snow. He grew up as the son of the owner of a construction company, and it was assumed he would join the business after high school. more >

Express Printing and Graphics, Inc.

Sara D. Vasquez, Owner

Sara D. Vasquez was born in Cúcuta Norte de Santander, Colombia. At the age of 18, Sara came to the United States, along with her mother, to make a change in her life that would benefit her and her yet, unborn child. The two arrived in Miami and began to work various jobs before relocating to Philadelphia to join extended family. In Philadelphia, Sara began working for her cousin, the previous owner of Express Graphics and Printing. It was here where Sara realized she had a natural affinity for business sales. more >

Clark’s Cellphone Corner

Sahira and James Hutson, President

The building that housed Clark’s Cellphone Corner was being foreclosed on by the bank and James and Sahira Hutson, the proprietors, were facing an inconvenient and costly relocation, plus the prospect of having to rebuild a clientele in a whole new location. These were not business moves that that they looked forward to. more >

Cibao Fried Chicken

The Peraltas, Owners

Nelson, Jr., Reyna, and Nelson, Sr.

On a corner property in North Philadelphia you’ll find a small, unassuming business named Cibao Fried Chicken, in an area surrounded by other small businesses and residences. Being part of a large city, the area is fairly quiet and appealing. Inside, it’s a lot less quiet. Owners Nelson Peralta, Sr., and his wife are working in a hot kitchen, cranking out the fried chicken and other Dominican specialties that the neighbors have found to be local favorites. more >

Lis Flor Creations

Florangel De La Cruz, Owner

First-generation Dominican American Florangel De La Cruz explains the origins of Lis FLor Creations. “It was always my dream to open a business. I made that a challenge I needed to achieve and it was very satisfying to accomplish it. What really gives me joy is to help others feel confident about themselves. I like what I do because I interact with people who may not feel good about themselves and when they get out of my chair, they feel like a million dollars.” more >

Blyss by Couryei

Couryei Cobb / Founder

When Couryei Cobb was working on her senior project at the Academy of Massage and Body Work in 2017, she thought that putting together a business plan for a beauty business was a great exercise that she enjoyed working through. It didn’t occur to her right away that she had actually designed her future! The plan was on point, and after graduation as a licensed aesthetician, she referred to it often as she created Bliss By Couryei, a beauty station in Newark, Delaware that offers waxing, facials, lashes and other personal services. more >

Financials

Consolidated Statement of Financial Position

December 31, 2021 and 2020

| ASSETS | 2021 | 2020 |

|---|---|---|

| Cash and Cash Equivalents | $3,354,700 | $3,286,568 |

| Restricted Cash | 5,726,836 | 2,835,721 |

| Investments | 48,535 | 48,515 |

| Grants Receivable, Net | 411,498 | 140,051 |

| Miscellaneous Receivable | 19,387 | 24,161 |

| Accrued Interest Receivable | 66,925 | 168,019 |

| Prepaid Expenses | 60,586 | 54,446 |

| Servicing Asset | 18,033 | 38,371 |

| Loans Receivable, Net | 10,020,352 | 7,503,994 |

| Equity in Investment - Related Party | 263,940 | 258,393 |

| Security Deposit | 1,427 | 1,427 |

| Property and Equipment, Net | 184,389 | 184,898 |

| TOTAL ASSETS | 20,176,608 | $14,544,564 |

| LIABILITIES AND NET ASSETS | 2021 | 2020 |

|---|---|---|

| Accounts Payable | 24,341 | $29,633 |

| Accrued Expenses | 15,550 | 21,532 |

| Deferred Revenue | 420 | 1,899 |

| Compensated Absences | 65,000 | 57,997 |

| Loan Escrow | 11,507 | 18,245 |

| Participation Balance Due to DEDA | 62,432 | 62,432 |

| Paycheck Protection Program Loan - Conditional Grant | - | 159,275 |

| Loans Payable, Net | 8,822,895 | 8,728,041 |

| Bonds Payable | 500,000 | 500,000 |

| TOTAL LIABILITIES | 9,502,145 | 9,579,054 |

| NET ASSETS | 2021 | 2020 |

|---|---|---|

| Without Donor Restrictions | 5,295,256 | 2,128,093 |

| With Donor Restrictions | 5,379,207 | 2,837,417 |

| TOTAL NET ASSETS | 10,674,463 | 4,965,510 |

| TOTAL LIABILITIES AND NET ASSETS | 20,176,608 | 14,544,564 |

Investors & Contributors

Investors

Artisans’ Bank

Barclays

Bank of Delaware

Borough of Kennett

Catholic Health Initiatives

Citizens Bank Customers Bank

Delaware Community Foundation

First Unitarian Church of Wilmington

Google

HSBC Bank USA, N.A.

M&T Bank

Northern Trust

Opportunity Finance Network

Sisters of St. Francis of Philadelphia

TD Bank, N.A.

USDA — Rural Development

U.S. Small Business Administration

WSFS Bank

Individual Contributors

Glenn Christman

Gloria Diodato

William Grimes

Vandell Hampton, Jr.

Sheila Harrigan

Deborah Harrison

Steve Horvath

Wanda Johnson

Daniel Kempski

Jonathon Klass

Delores Lee

Glenda Machia

Phyllis McCollum

Justin Poser

Ronaldo Tello

Clinton Tymes

Pedro Viera

Abdullah Weeks

Contributors

Artisans’ Bank

Ashley Biden Livelihood Foundation

Bank of America

Charitable Foundation

Citizens Bank

City of Wilmington

Comenity Bank

Community Development Financial Institution

Delaware Alliance for Nonprofit Advancement

Delaware Community Foundation

Discover Bank

Economic Development Administration

JPMorgan Chase Foundation

Laffey-McHugh Foundation

Losco & Marconi

M&T Bank

PNC Bank

Santander Bank

State of Delaware

TD Bank, N.A.

USDA - Rural Development

U. S. Small Business Administration

Wells Fargo Foundation

Wilmington University

WSFS