[button]

[button]

Empowering Possibilies,

Planning for Growth

True Access Capital is a nonprofit Community Development Financial Institution (CDFI) that offers access to capital, technical assistance and business support to small businesses and entrepreneurs, located in Delaware, and in Southeastern Pennsylvania. True Access Capital builds wealth and strengthens communities by helping small businesses, primarily led-by and in-service-to, women and all people of color. Most of True Access Capital’s work is focused in low-wealth communities. Watch the video!

Vandell Hampton, Jr.

President & CEO

Helping Build Communities

“Our hope is that we’re able to help build communities by providing access and opportunity for small business owners through our lending and technical assistance services, which enables communities to prosper. Since our founding in 1992, True Access Capital has provided over $58 million to support more than 1,500 small businesses and community organizations.”

Supporting Entrepreneurs Through

The Northeast Revitalization Fund

The Northeast Revitalization Fund was established by True Access Capital in 2021, to support small development projects in Wilmington’s Northeast corridor. The program provides loans up to $500,000, at a low-interest rate and the potential for 30 percent loan forgiveness, upon completion of the project.

Mathew Minor

Subcool Properties

“At Sub Cool Properties, we buy, rehab and sell properties. I focus on the north side of Wilmington because I’m from there. True Access makes it possible for young people who look like me to own a business. Hopefully, we come up with businesses that benefit and lift this community up.”

“I acquired a large commercial building — an old firehouse — with a parking lot. I worked on it for several years with my own funds, but it got to a point where I needed assistance to continue with the dream that I had for that building. That’s where True Access came in.”

David Wilford

Wilford Enterprises, LLC

Richard Dyton

Ark Learning Centers

“True Access Capital provided me with funding to purchase and rehab a nice facility. A lot of people go into projects not having enough funding and fall short. True Access Capital is focused on seeing the community evolve and seeing people succeed.”

True Access Capital's Empowerment Fund,

Enabling Entrepreneurs to Realize Their Dreams

Empowerment Fund loans support businesses led by Black, Indigenous, and People of Color (BIPOC) entrepreneurs in the City of Wilmington. Loans at advantageous interest rates include the potential for grants up to 20 percent of the total project.

Kamil Bass-Walker

Eat Clean Juice Bar

North Market Street, Wilmington

"The best part of working with True Access Capital is that from beginning to end, they wanted you to succeed. They provided resources in every aspect of business, from funding to assistance with marketing and accounting.”

“As a new business, there were somethings that we didn’t know we needed, which True Access helped us work through. Their technical assistance programs and initiatives were exceptional.”

James Bradford III

Troisieme Café

Brandywine Village, Wilmington

Elorm Ahiamadjie (left)

CEO and Co-founder of Delaware Limo

Wilmington

“Because we were so new and growing so rapidly, traditional banks looked at our company as a risk. So even if we did get approved for financing, the rates and terms were unfavorable. True Access Capital was much different because they offered better terms and held our hands through the process.”

The Women’s Business Center at True Access Capital (WBC) provides intensive, outcome-oriented business services and in-depth technical assistance and training to primarily women-owned businesses. WBC trainings, events, and one-on-one counseling cover fundamental and higher level trainings to assist in starting or growing a business.

Training courses include business planning, business financing, social media and marketing. In addition, all WBC clients have the opportunity to network with and learn from successful business owners and entrepreneurs.

Our partnerships with Small Business Administration (SBA), Service Core of Retired Executives (SCORE), the Small Business Development Center Network (SBDC), provide resources to ensure that entrepreneurs know the business fundamentals. We focus on helping small- and women-owned businesses succeed!

True Access Capital 2022 Financials

Impact

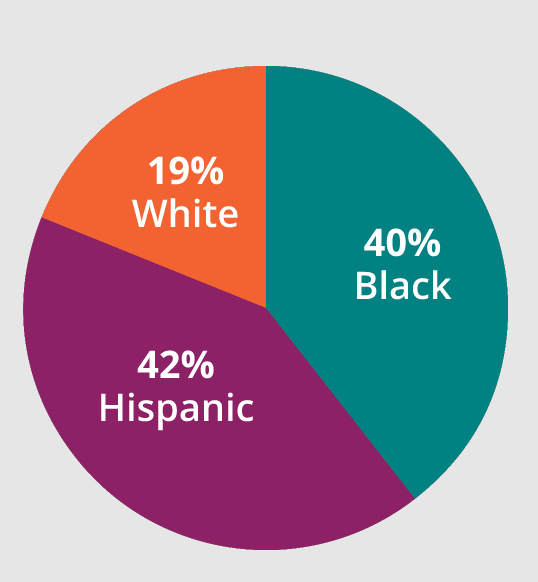

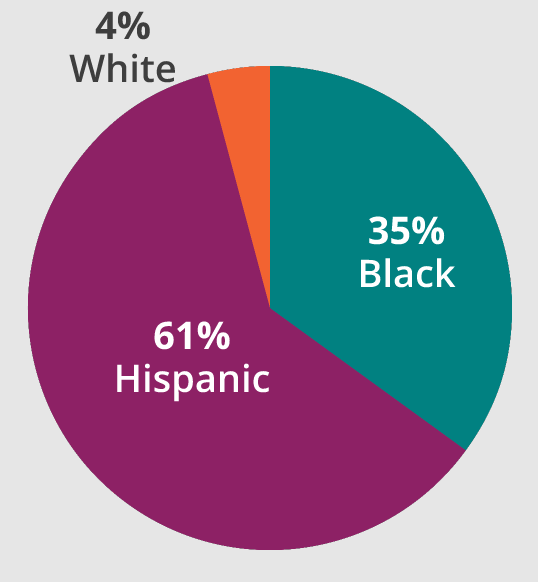

NUMBER OF LOANS

DOLLAR AMOUNT OF LOANS

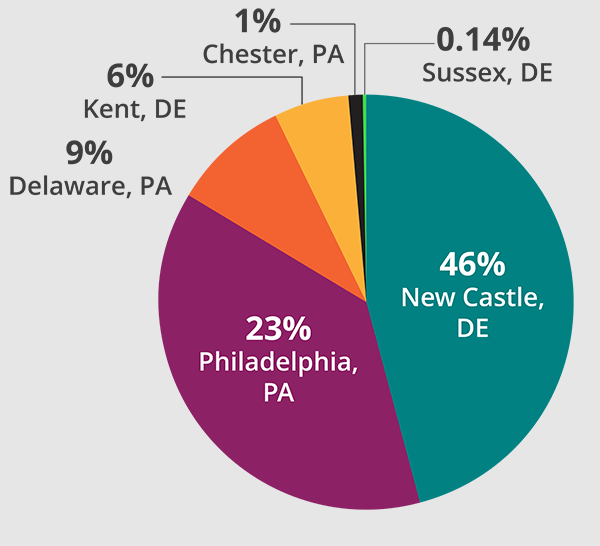

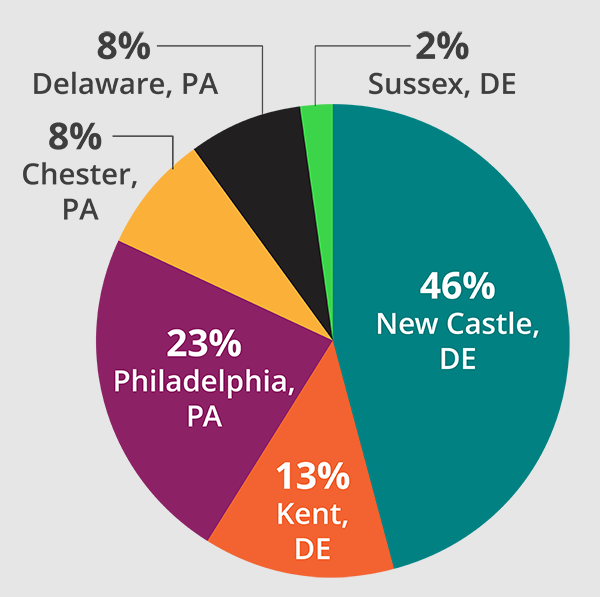

NUMBER OF LOANS BY COUNTY

LOANS DOLLAR AMOUNT BY COUNTY

Statement of Financial Position

December 31, 2019 through 2022

| 2019 | 2020 | 2021 | 2022 | |

|---|---|---|---|---|

| Total Assets | $11,567,842 | $14,544,564 | $20,176,608 | $22,058,882 |

| Total Liabilities | $7,845,853 | $9,579,054 | $9,502,145 | $7,328,950 |

| Net Assets | $3,721,989 | $4,965,510 | $10,674,463 | $10,307,283 |

| Total Liabilities & Net Assets | $11,567,842 | $14,544,564 | $20,176,608 | $22,058,882 |

2022 Investors and Contributors

Investors

Artisans’ Bank

Barclays Bank of Delaware

Borough of Kennett

Catholic Health Initiatives

Citizens Bank

Customers Bank

Delaware Community Foundation

First Unitarian Church of Wilmington

Google

HSBC Bank USA, N.A.

M&T Bank

Northern Trust

Opportunity Finance Network

TD Bank, N.A.

USDA — Rural Development

U.S. Small Business Administration

WSFS Bank

Individual Contributors

Glenn Christman

Vandell Hampton, Jr.

Deborah Harrison

Daniel Kempski

Delores Lee

Phyllis McCollum

Clinton Tymes

Pedro Viera

Jimmy Jarrell

Contributors

Artisans’ Bank

Ashley Biden Livelihood Foundation

Bank of America Charitable Foundation

Citizens Bank

City of Wilmington

Comenity Bank

Community Development Financial Institution

Delaware Alliance for Nonprofit Advancement

Delaware Community Foundation

Discover Bank

Economic Development Administration

JPMorgan Chase Foundation

Laffey-McHugh Foundation

Losco & Marconi

M&T Bank

PNC Bank

Santander Bank

State of Delaware

TD Bank, N.A.

USDA - Rural Development

U. S. Small Business Administration

Wells Fargo Foundation

Wilmington University

WSFS